Your largest competitor just spent two million dollars on a customer data platform. They have dashboards for everything: purchase history, browsing behavior, predicted lifetime value, churn risk scores. You have a few spreadsheets, maybe a basic CRM with contact information for thirty percent of your customers. That gap feels intimidating.

Here is the counterintuitive truth: small and mid-sized businesses can build better customer data relationships than enterprises. You do not need a massive martech stack to win. You need a clear first-party data strategy, a fair value exchange, and systems that your team can actually run.

Table of Contents

Section 1: The First-Party Data Imperative for SMBs

First-party data has become the foundation of modern marketing. As third-party cookies disappear and privacy regulations tighten, the future belongs to businesses that collect data directly from their customers with consent and a clear value exchange. For SMBs, this is not only a compliance topic. It is a strategic chance to build an asset that big competitors cannot easily copy.

What First-Party Data Actually Is

For SMBs, first-party data is any information you collect directly from customers through your own channels, with their knowledge and permission. It includes what they tell you and what they do on your properties.

| Data Type | Definition | Ownership |

|---|---|---|

| First-Party | Data collected on your own channels. Examples: purchase history in your POS, email signups, website behavior on your domain, loyalty interactions. | Fully yours, within consent and regulation. Highest long term value. |

| Second-Party | Another company's first-party data shared via partnership. Example: co-branded webinar where both parties access registrations. | Shared. Depends on contract and customer consent. |

| Third-Party | Data bought or rented from brokers and platforms. Examples: cookie audiences, rented email lists. | Rented and shrinking. High risk, declining performance. |

| Zero-Party | Data customers intentionally give you through surveys, quizzes, preference centers, and missions. | Gold Standard. Explicit and high signal. |

Why It Matters More Than Ever

- Third-party cookies are going away: Chrome is phasing them out, Safari and Firefox already block them. Retargeting and attribution based on third-party cookies are breaking.

- Privacy rules require true consent: GDPR, CCPA, LGPD and similar regulations expect explicit opt in, clear purposes, and real control for customers.

- Purchased data is weaker and more expensive: List quality is often poor. Consent chains are unclear, which increases both cost and risk.

- First-party data is proprietary: Your customer profiles and preference signals are not available in any marketplace. They become part of your competitive moat.

- Better data increases lifetime value: Customers with complete profiles usually respond better to campaigns, churn less, and buy more. A 20 to 40 percent lift in LTV is realistic when you move from shallow to rich data.

The SMB Advantage

Enterprises may have more tools, but you have advantages they cannot buy.

- Speed: Big companies need months of approvals and IT projects. You can launch a QR campaign or survey this week.

- Authenticity: In smaller businesses, customers have names and faces, not just IDs. This makes trust and consent conversations much easier.

- Transparency: You can say in human language: “We collect your email to send weekly specials and rewards. That is all.” That clarity is harder for enterprise legal teams.

- Fair value exchange: Instead of demanding free data, you can offer concrete value in return, such as rewards, better service or truly relevant personalization.

This guide is written for businesses in the two to fifty million dollar revenue range, with one to five marketing people and limited IT support. The goal is simple: show you how to build first-party data capabilities in ninety days, using tools you can afford and processes your existing team can run.

Section 2: Compliance Made Simple for SMBs

Privacy compliance sounds like lawyers, long policies and big bills. For most SMBs, it comes down to one simple principle.

The Golden Rule: Collect data transparently, with consent, for specific purposes, and give customers control over it.

Regulations change and differ by region, but they orbit this same idea. If you design your flows around this rule and document what you do, you are already most of the way there.

GDPR in Plain Language

GDPR applies if you have customers in the European Union, even if your business is based elsewhere. There is no exemption just because you are small. Key ideas:

- Lawful basis: For each data use you need a legal reason. Marketing usually requires explicit consent. Order fulfillment uses contractual necessity. Fraud prevention may rely on legitimate interest.

- Consent: Opt in, not opt out. No pre checked boxes. You must say what you will send and how often, and unsubscribing must be easy.

- Data rights: Customers can request a copy of their data, ask for corrections, request deletion when appropriate, and ask for export in a readable format.

- Data protection: Collect only what you need, keep it only as long as necessary, and protect it with reasonable technical and procedural measures.

CCPA and Similar State Laws

CCPA focuses on California, but similar laws are spreading across the United States. Many SMBs do not hit the formal thresholds yet, but aligning with its spirit is smart because it sets expectations for transparency.

- Provide clear notice at the moment of data collection.

- Explain how customers can request access and deletion of their data.

- If you ever sell data, provide a “Do Not Sell My Personal Information” option.

Other Key Regulations

Brazil's LGPD, Canada's PIPEDA, and new state level laws follow similar principles. They all care about consent, purpose limitation, security and rights to see, correct and delete data. If you build for GDPR plus CCPA style transparency, you are in good shape for most frameworks.

Practical Compliance Checklist

- Privacy policy: A clear page that explains what you collect, why, how long you keep it, who you share it with, and how customers can reach you about their data.

- Consent mechanisms: Unchecked boxes for marketing with plain language such as “I agree to receive promotional emails.”

- Clean forms: Ask only for data you actually use. If you never call customers, do not make phone mandatory.

- Unsubscribe link: Present and working in every marketing email. Remove or stop targeting within a few days.

- Data request process: A simple address or form where customers can request access, deletion or export. Document how your team responds within thirty days.

- Security basics: HTTPS website, unique logins for each staff member, minimal access to databases, regular backups.

- Vendor checks: Use tools that publish their own compliance details and sign data processing agreements where needed.

- Staff training: Anyone touching customer data should know what counts as personal data, what can and cannot be shared, and how to escalate a suspected incident.

How VISU Helps: VISU is designed around explicit consent and clear purpose. Every survey or QR campaign requires customers to opt in, and each flow explains what is collected and why. Consent timestamps and responses are stored automatically, so you have an audit trail without building your own logging system from scratch. Customers can view, export or request deletion of their data through VISU, and core security elements such as encryption and access control are handled at platform level.

Section 3: 10 Practical First-Party Data Collection Methods

You do not need a complex stack to start collecting valuable first-party data. You need a few channels that fit your business model, plus incentives that make customers happy to participate. Below are ten methods that SMBs can roll out quickly, many at very low cost.

1. Website Forms

Website forms are the classic entry point. They collect basic information in exchange for a clear benefit such as a discount, early access or useful content. Start with email and one or two contextual fields. Explain exactly what someone will receive and how often.

VISU enhancement: Instead of a static form, embed a short VISU survey that says “Answer three quick questions and earn one dollar.” This turns a passive form into an active value exchange and increases completion significantly.

2. Surveys

Surveys are your main tool to collect zero-party data: motivations, preferences, satisfaction drivers and competitive insights. Run post purchase surveys, profile completion surveys, new concept tests and periodic pulse checks.

Without rewards, most surveys see completion rates in the ten to fifteen percent range. With VISU style rewards, completion often jumps to sixty to eighty percent. Customers do not hate surveys. They hate feeling used for free.

3. Loyalty Programs

Loyalty programs connect purchases across time and channels to a single identity. Even simple point programs allow you to see frequency, recency and value per customer. When you layer surveys and missions on top, you get a rich view of both behavior and preferences.

VISU enhancement: Run dual incentives. Points in your own program plus VISU rewards for data enrichment missions such as completing profile fields, answering feedback questions or testing new products.

4. Purchase Data and Receipts

Every transaction contains useful first-party data: what was bought, for how much, how often and on which channel. The missing piece is usually identity. Offer digital receipts by email or give a VISU reward for scanning a QR code printed on receipts to rate the visit. That one scan links a previously anonymous purchase to a profile you can use later.

5. Email Engagement

Email is still one of your most controllable channels. Opens, clicks and replies show you what topics matter, which segments are at risk and who is becoming a superfan.

- Segment by engagement level and tune frequency.

- Send short VISU surveys only to active segments, where response rates are highest.

- Use links and clicks to refine interest tags in your CRM.

6. Customer Service Interactions

Support calls, chats and emails are full of signals. They reveal why customers are frustrated, what they did not understand, how they compare you with competitors and what keeps them loyal.

Give your team a simple tagging scheme in your CRM and follow each resolved interaction with a one minute VISU survey that asks “How did we do?” in exchange for a small reward. Over time you will see patterns you can fix once instead of answering case by case forever.

7. Events and Webinars

Events, whether local or online, are perfect data collection opportunities because people expect to register and answer questions. Collect contact details at registration and then use VISU QR codes or links during the event for live feedback and post event surveys.

In a B2B context you can gather job role, company size and current tools. In B2C you can ask about visit frequency, spending patterns and product interest.

8. Contests and Sweepstakes

Giveaways and contests can generate fast bursts of first-party data. The key is to align the prize with your real customer. A large gift card to your store attracts better leads than a generic gadget.

Use VISU to guarantee a small reward to every participant plus a larger prize for a few winners. That combination drives participation while keeping cost per profile under control. Make sure your rules and disclosures follow local laws.

9. Social Media Engagement

Social platforms give you reach, but the data lives on their side until you convert followers into owned contacts. Use content that points people to VISU surveys in your bio link or stories. For example: “Take this two minute money habits quiz and earn a dollar.”

Each completion gives you contact details plus structured answers, which is far more valuable than a like or comment that disappears in the feed.

10. QR Code Campaigns

QR codes are the bridge between physical experiences and digital profiles. If you have a store, restaurant, packaging, flyers, delivery bags or event signage, you can place QR codes anywhere customers already look.

With VISU, each scan can trigger a short, rewarded survey such as “Answer five questions and earn one dollar.” You capture scan time, context and detailed answers in a single flow. This is especially powerful for restaurants, retail, events and any phygital experience where you want to close the loop between offline and online behavior.

Which Methods to Prioritize First

| Goal | Best Methods | Typical Timeline |

|---|---|---|

| Build email list fast | Website forms, contests, VISU surveys from social | 1 to 3 months |

| Understand preferences | Surveys, loyalty data, QR feedback | Ongoing |

| Increase repeat purchases | Loyalty programs, email triggers, profile based offers | 3 to 6 months |

| Connect physical and digital | QR codes on receipts, packaging and in-store signage | 1 to 2 months |

Section 4: Designing Value Exchanges Customers Accept

Most customers are no longer willing to hand over data just because a form asks nicely. You need an exchange that feels fair and concrete, where both sides can see the benefit.

The Value Exchange Spectrum

Think of your offers on a spectrum from low to high value.

| Value Level | Examples | Typical Conversion |

|---|---|---|

| Low Value | Vague “exclusive offers”, generic newsletters, forced cookie banners with no visible gain. | Low opt in rates and many fake emails. |

| Medium Value | Ten percent off first order, order tracking, standard account area. | Roughly 20 to 30 percent participation. |

| High Value | Direct cash rewards via VISU, meaningful discounts, early access to limited products, better service tiers. | Often 50 to 80 percent participation. |

Why VISU Style Cash Rewards Work

Cash rewards create a simple, universal transaction: a few minutes of attention in exchange for a clear amount of money.

- Universality: Everyone understands the value of one dollar, independent of category.

- Immediacy: Rewards arrive right after completion, not “someday” points that might expire.

- Gamification: Customers see their earnings accumulate over time, which makes participation feel like progress, not work.

- Accuracy: If future earning potential depends on their profile, customers are more inclined to give real information and keep it updated.

From the business side, the economics are also attractive. If an average complete profile increases LTV by even twenty or thirty dollars, investing two to five dollars in rewards can be entirely rational.

Alternative Value Exchanges (Non Cash)

Cash is powerful, but not always the only or best option. Other formats can make more sense for certain brands and audiences.

- Early access: Data rich customers get first choice on new drops, bookings or limited capacity events.

- Stronger personalization: Show clearly that sharing preferences leads to better recommendations, curated bundles or content that saves them time.

- Service upgrades: Offer extended return windows, priority support or member only hours for people who keep their profiles complete.

- Community perks: Private groups, live Q and A sessions or behind the scenes content for high value members.

- Charity matching: For some audiences, turning survey rewards into donations on their behalf is more motivating than personal cash.

A Simple Framework for Value Design

- Decide what data you truly need. Start with fields that directly drive revenue or experience, such as email, purchase intent and category preferences.

- Estimate the financial impact. If better data raises LTV by eighty dollars, that is your upside per complete profile.

- Choose a fair reward level. Offering 10 to 30 percent of that upside back to the customer keeps the model sustainable.

- Break the process into steps. Do not ask for twenty fields at once. Start with email, then use VISU missions and surveys to progressively enrich profiles.

- Test and refine. Experiment with reward amounts, survey lengths and messaging until you find the best balance between completion rate and cost per profile.

If you can put a number on LTV uplift and on cost per complete profile, value exchange decisions stop being guesswork and become simple math.

Section 5: Technology Stack for SMB First-Party Data

You do not need the exact stack that your enterprise competitor uses. You need a combination of tools that fits your budget, your skills and the number of channels you plan to run.

The Essentials Under 500 Dollars per Month

A practical SMB stack usually includes five core components.

| Component | Function | SMB Tool Examples |

|---|---|---|

| CRM | Central database for customer details and interactions. | HubSpot CRM, Zoho CRM, Pipedrive |

| Email Platform | Campaigns, automation and basic segmentation. | MailerLite, ConvertKit, Klaviyo |

| Data Engine | Surveys, rewards, QR campaigns, profile enrichment. | VISU |

| Analytics | Website and funnel performance. | Google Analytics 4, Plausible |

| Consent Management | Cookie banners, preferences and policy documentation. | Cookiebot, Osano, Termly |

Starter Stack vs Growth Stack

Starter Stack (almost free):

- HubSpot CRM Free or Zoho Free as your contact database.

- MailerLite Free or another entry level email tool for basic campaigns.

- Google Forms for initial surveys, Google Analytics 4 for analytics.

- A simple cookie banner from a free consent tool.

This stack costs very little and is enough to prove that first-party data can move your numbers.

Growth Stack (investing in acceleration):

- Paid CRM tier for more automation and reporting.

- More advanced email platform with strong segmentation and revenue tracking.

- VISU as your dedicated first-party data engine with reward flows and QR campaigns.

- Lightweight consent and analytics tools that simplify reporting.

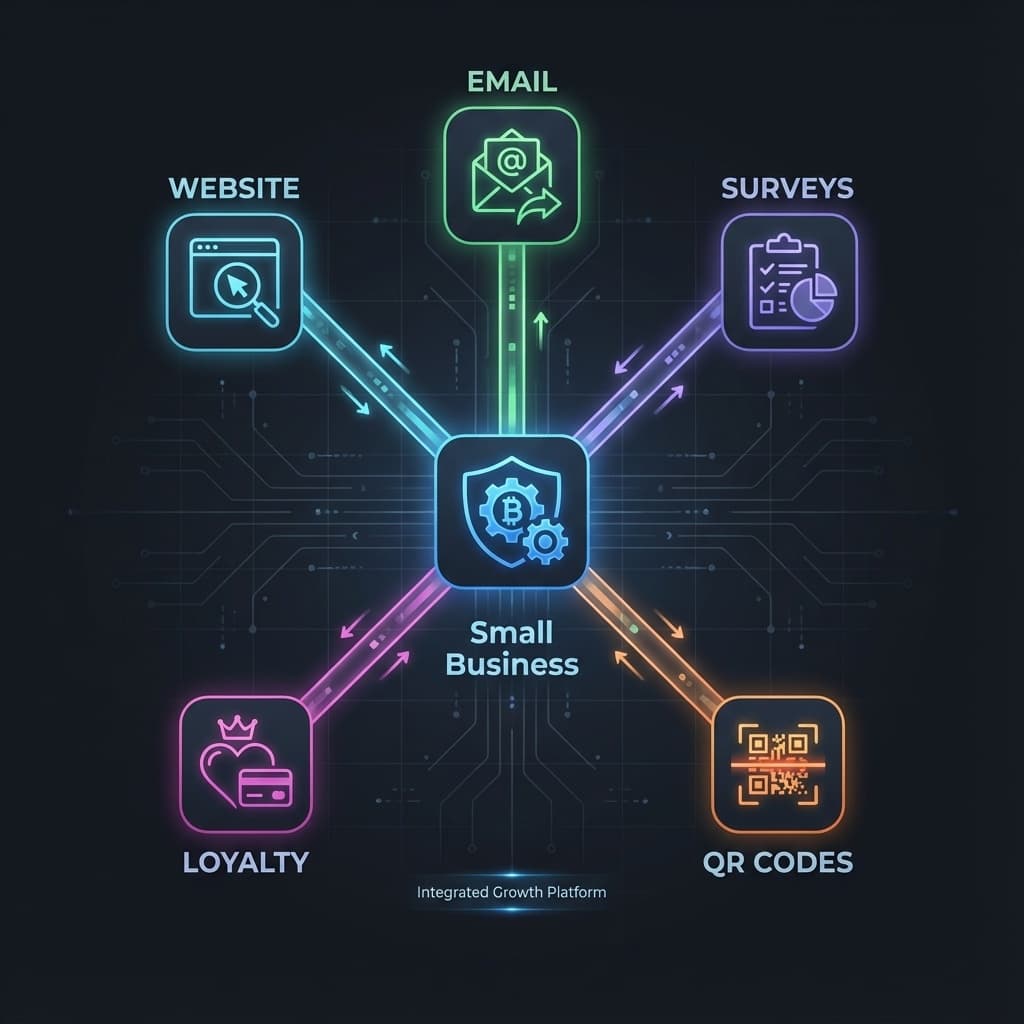

Where VISU Fits in the Stack

VISU acts as your first-party data engine. It combines survey building, QR campaigns, reward distribution, consent tracking and analytics in one platform.

Instead of paying separately for a survey tool, reward infrastructure, QR platform and parts of a customer data platform, you run campaigns inside VISU and connect the resulting profiles into your CRM and email system. This reduces integration work and gives you one place to see how each campaign contributes to your data asset and to revenue.

Section 6: Data Governance Basics for SMBs

Data governance for SMBs does not mean a thick policy manual that nobody reads. It means knowing who owns which data, who is allowed to touch it, how long you keep it and what you do when something goes wrong.

A Simple Ownership Structure

Start by assigning clear ownership for each major data category.

- Customer contact data: Owned by marketing. Sales and service have read only access for follow ups but cannot export lists freely.

- Purchase history: Owned by operations or finance. Marketing uses it for segmentation and reporting, but structural changes flow through owners.

- Survey and preference data: Owned by marketing or a data lead. Product teams and leadership receive aggregated or anonymized views unless personally identifiable data is strictly necessary.

- Retention rules: Marketing data for inactive contacts is purged or anonymized after roughly twenty four months. Purchase records follow tax and accounting rules, often seven years or more. Survey responses are kept for a defined period, for example three years, or removed on customer request.

Security Basics Under One Hundred Dollars per Month

- Individual logins: No shared passwords for email, CRM, VISU or analytics. Every team member has their own account.

- Role based permissions: Control who can see exports, payment data or sensitive notes.

- Encryption and 2FA: Your website runs on HTTPS with a valid certificate, and all admin panels use strong passwords plus two factor authentication where available.

- Regular backups: Monthly exports of core datasets such as CRM contacts and VISU profiles to encrypted cloud storage, with test restores at least once a quarter.

- Staff training: Regular reminders about phishing, unsafe links and password hygiene, plus a simple process to report suspicious events.

Minimal Documentation That Works

For most SMBs, a single shared document is enough to start. It should describe:

- Which systems hold which data.

- Who owns each system and what each role can do inside it.

- Retention schedules for different data types.

- Incident response steps, such as who to call and which actions to take if a file is sent to the wrong person or an account is compromised.

VISU support: VISU centralizes consent information, campaign activity and mission history. This gives you an audit trail for how data was collected without building custom logging, and simplifies your documentation work.

Section 7: A 90-Day Implementation Roadmap

Building a first-party data program does not require a multi year transformation. You can make real progress in ninety days if you focus on foundations first, then collection, then integration.

| Phase | Key Actions | Success Metric |

|---|---|---|

| Month 1: Foundation | Audit data, update privacy policy, set up VISU account, connect CRM and email, launch first web survey. | Systems ready and first 50 responses collected. |

| Month 2: Scale Collection | Deploy QR codes on packaging and receipts. Send a profile completion campaign to your email list. Promote surveys via social. | 500 or more profiles with meaningful fields filled in. |

| Month 3: Integration and Monetization | Sync VISU data to CRM. Create high value segments. Launch personalized email and offer flows based on new data. | Visible lift in open rates and first revenue attribution to data based campaigns. |

Weeks 1 to 2: Inventory what you already have: CRM, email lists, purchase exports, loyalty files and past surveys. Clean obvious issues such as bounces and duplicates. Update your privacy policy and add consent checkboxes to existing forms.

Weeks 3 to 4: Set up VISU, connect it to your main tools and launch your first simple campaign: a profile completion or welcome survey with a small reward.

Weeks 5 to 8: Add QR codes to receipts, packaging and key in store spots. Send a VISU survey to your existing email list. Watch which channels convert best and which questions people skip.

Weeks 9 to 12: Push VISU data into your CRM, build segments and run basic data driven campaigns such as targeted reactivation or tailored product recommendations. Measure how data rich segments perform versus the rest.

Section 8: Competitive Strategies for SMBs

Your competitors may have larger budgets, but you can still build a durable moat around your strongest customers by competing on trust, speed and quality instead of pure reach.

1. Compete on Trust, Not Surveillance

Many large brands still rely on tracking techniques and opaque data deals. Customers feel monitored, not respected. You can position your business differently.

- Be upfront: “We collect your data only when you choose, and we never sell it.”

- Show the trade: “Answer these questions and earn cash, discounts or service upgrades.”

- Make control visible: Simple preference centers and easy unsubscribe buttons build confidence.

2. Use Surveys for Competitive Intelligence

With VISU, you can go beyond basic demographics and ask directly about your position in the market.

- “What made you choose us over other options?”

- “Which alternatives did you consider before buying from us?”

- “What would make you switch to another provider?”

Patterns in the answers show you which strengths to double down on and which weaknesses to fix before competitors exploit them.

3. Move Faster Than Enterprise

Enterprise roadmaps often take six to twelve months between idea and rollout. With a lean team and VISU, you can design and launch a new survey campaign in a few days. Use that speed as a weapon. Test new concepts on small segments, read the data, iterate and only then scale. By the time a bigger competitor has aligned stakeholders, you already know what works in your customer base.

4. Quality Over Quantity

You do not need one hundred thousand profiles to win. Five thousand clean, consented, data rich profiles that include purchase history and preferences can outperform a huge but shallow database in revenue and satisfaction.

Because VISU combines zero-party data (what customers say) with first-party behavioral data (what they actually do), you end up with a proprietary dataset that is hard to replicate even if a competitor targets the same city or niche.

Section 9: Measurement and Optimization

To keep stakeholders on board, you need a simple way to show that your first-party data program is working. You do not need complex attribution models. You need a small set of metrics that link collection efforts to business results.

Core KPIs to Track

- Data collection rate: Percentage of customers who provide data when asked, broken down by channel and campaign.

- Profile completeness: Share of key fields that are filled in for each customer, averaged across the base.

- Cost per complete profile: Total rewards and platform costs divided by the number of customers who reach your target completeness threshold.

- LTV lift: Difference in revenue per customer between data rich and data poor segments over a given period.

- Engagement lift: Differences in open, click and conversion rates between segments with and without VISU data.

A Simple ROI Example

Imagine you spend one thousand dollars per month across VISU fees, rewards and internal labor. That investment generates one hundred new complete profiles each month.

If data rich customers have an LTV that is eighty dollars higher than average, those one hundred profiles represent eight thousand dollars in future revenue potential. Even if only part of that uplift is realized in the first year, the upside relative to cost is significant.

How to Optimize Over Time

- Improve collection: Test different reward levels, survey lengths and placements to reduce drop off and increase completion.

- Enhance data quality: Add occasional verification questions, avoid leading wording and remove obviously inconsistent answers.

- Increase business impact: Use your new segments to run tailored campaigns such as reactivation for at risk high value customers, upsell offers for specific preference clusters and loyalty missions for your best buyers.

VISU helps by giving you campaign level analytics and benchmarks so you can see what is normal in your category and where you are outperforming or underperforming.

Section 10: Conclusion and Next Steps

The shift from third-party to first-party data is not only about compliance. It is a chance to rebuild how you relate to customers. Instead of tracking them in the background, you invite them into a clear, fair and rewarding relationship.

SMBs have real advantages here. You can act quickly, communicate in human language and build trust through transparent practices and better experiences. You do not have to replicate enterprise stacks. You only have to get very good at collecting the right information from the right people, using tools you can manage.

VISU accelerates this journey. It turns surveys, QR codes and missions into a consistent, reward based system that customers enjoy using. It handles consent, security and infrastructure so your team can focus on using insights instead of wrestling with tools.

Your next steps can be very concrete:

- This week: audit your current data, privacy policy and collection points.

- Next week: set up or connect your VISU account and launch your first rewarded survey.

- Month one: add QR codes to key touchpoints such as receipts and packaging, and start segmenting by profile completeness.

- Month two: scale the channels and campaigns that perform best and begin basic personalization in your email and loyalty flows.

- Month three: measure LTV and engagement differences, summarize results and plan a second wave of campaigns built on what you learned.

Businesses that invest in first-party data now will have a durable advantage as third-party signals disappear. The bar is still low in most markets. If you start now and stay consistent, you can build a first-party data asset that is hard to copy and easy to monetize.

Build Your Data Engine Today

Stop relying on rented audiences. Start building an owned asset of first-party data with VISU's consent based reward platform.Frequently Asked Questions

Do I need a dedicated data team?

No. Most SMBs run effective first-party data programs with one marketing owner and partial support from operations or customer service. Tools like VISU hide technical complexity and provide clear workflows.

How much should I budget for rewards?

Many SMBs start with a reward budget between 500 and 2,000 dollars per month. The exact number should be tied to your expected LTV uplift and how aggressively you want to grow your profile base in the next year.

What if customers provide fake data?

Because VISU rewards are small but recurring and tied to ongoing missions, most customers quickly learn that accurate profiles unlock better rewards and more relevant offers. You can also add simple verification questions and filters to reduce low quality responses.

Can I connect VISU to my CRM?

Yes. VISU is usually layered on top of your existing stack as a data collection and engagement engine. It can feed structured survey and QR scan data into major CRMs via API, webhooks or simple CSV exports.