Cashback rates are dropping, apps are shutting down, and rewards keep getting harder to earn. Is this the end of easy money from shopping?

If you've been using cashback apps for a while, you've probably noticed something: the rewards aren't what they used to be. That 5% cashback is now 2%. The $5 signup bonus became $2. Some apps you loved just disappeared entirely. It's not your imagination, and it's not just one or two apps having a bad year.

The cashback industry is going through real changes, and understanding what's happening helps you adapt before you're left earning pennies. Here's what's actually going on, which apps are likely to survive, and where smart earners are shifting their attention.

Earn Beyond Cashback

While cashback rates drop, attention-based rewards are growing. VISU pays for engagement that doesn't depend on how much you spend.

Quick video. Earn your first reward.

What's Actually Happening to Cashback

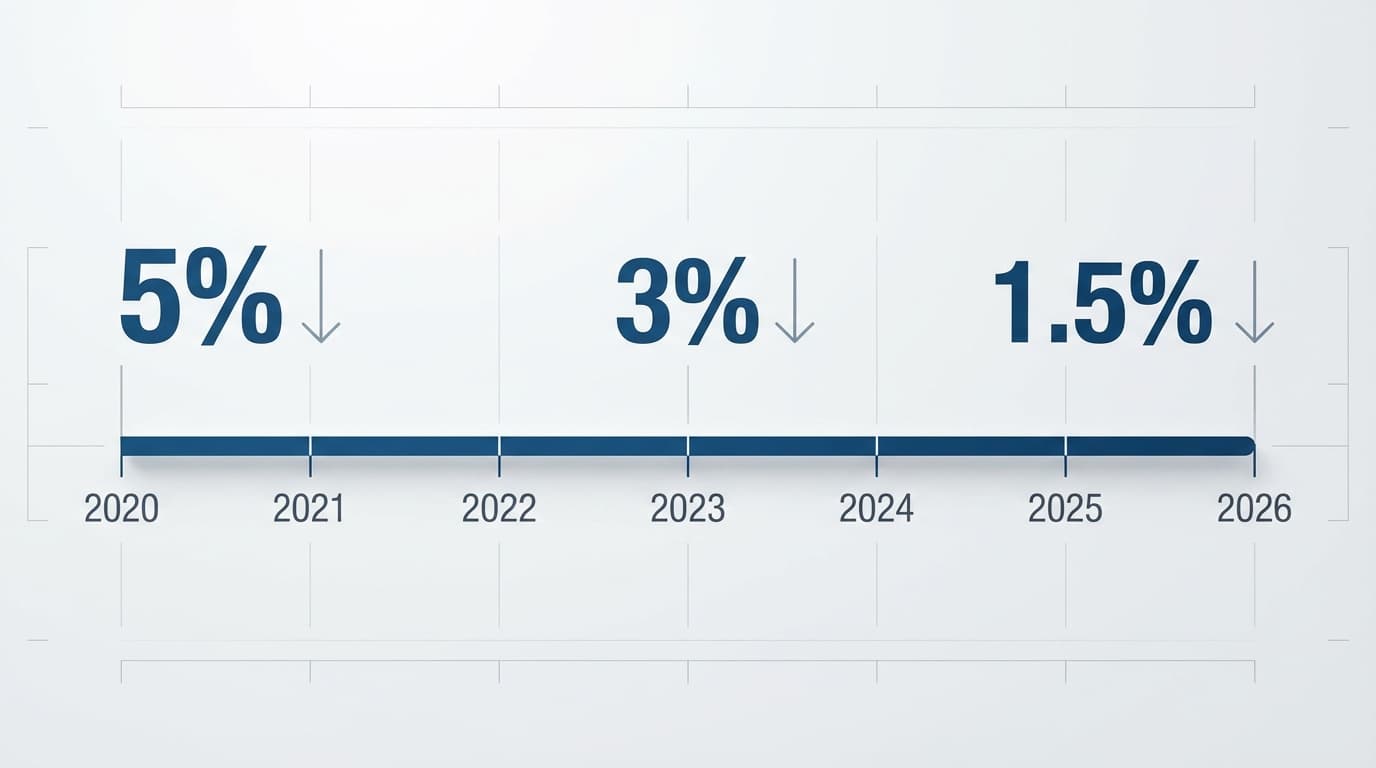

The cashback model isn't dying overnight, but it's definitely shrinking. Average cashback rates across major apps dropped from around 4-5% in 2020 to 1-2% in 2025. Some categories that used to pay 10% or more now pay 3% on a good day. The generous signup bonuses that apps used to throw around have gotten smaller and harder to qualify for.

Several mid-size cashback apps have shut down or been acquired in the past two years. Others have quietly reduced their rates, increased minimum payouts, or added more restrictions on what qualifies. The apps that remain are profitable, but they're profitable partly because they're paying users less.

This isn't unique to cashback. The entire "pay users to do things" economy is maturing. Early apps subsidized rewards with investor money to grow fast. Now investors want profits, which means the easy money era is ending. Apps that survive will be the ones with sustainable business models, not the ones burning cash to acquire users.

Why Cashback Rates Are Declining

Understanding why this is happening helps you see where things are headed. Several forces are squeezing the cashback model from different directions.

Retail Margins Are Thin

Cashback comes from retailer commissions. When you buy something through a cashback app, the retailer pays the app a commission (say, 8%), and the app shares part of that with you (say, 4%). But retail margins have been compressed by competition, inflation, and supply chain costs. Retailers are paying smaller commissions because they have less margin to share. When the commission drops from 8% to 5%, your cashback drops proportionally.

User Acquisition Costs Changed

Early cashback apps paid high rates to acquire users quickly. Venture capital funded these losses because growth was the goal. Now investors want profitability, and paying 5% cashback on every purchase isn't profitable for most apps. The apps that scaled successfully have leverage to negotiate better deals with retailers. The ones that didn't are struggling or gone.

Data Value Is Shifting

Many cashback apps make money by selling shopping data to brands and market researchers. This data business subsidized rewards for years. But data privacy regulations and platform changes (like Apple's App Tracking Transparency) have made this data less valuable and harder to collect. Less data revenue means less money to share with users as cashback.

Market Saturation

When apps that pay for receipts were new, retailers paid premium rates for access to this marketing channel. Now there are dozens of cashback apps competing for the same retailer relationships. Competition has driven down the commissions apps can negotiate, which flows through to lower user rewards.

Which Apps Are at Risk

Not all cashback apps face the same challenges. Some business models are more vulnerable than others.

Pure Receipt Scanning Apps

Apps that only pay for scanning receipts have the thinnest business model. They rely entirely on selling shopping data, which is getting harder and less lucrative. These apps typically pay the least per receipt ($0.01-0.05) and have the least differentiation. If they can't find additional revenue streams, many won't survive the next few years.

Apps With High Minimum Payouts

Apps that require $25 or more to cash out are fighting an uphill battle. Users get frustrated waiting months to see any money, engagement drops, and the app loses the active user base it needs to attract retailers. Low-minimum apps like those with instant payouts have a retention advantage.

Apps Without Retailer Integration

Cashback apps that just scan receipts after the fact are less valuable to retailers than apps with direct integration (like linked card programs or affiliate links). Retailers prefer apps where they can see the attribution clearly and influence purchasing decisions before they happen. Apps without these integrations are at a disadvantage in negotiating commissions.

Apps Dependent on Single Categories

Apps focused heavily on one category (like grocery-only or gas-only) are vulnerable to changes in that sector. When one major grocery chain drops their partnership, these apps lose a huge chunk of their value proposition. Diversified apps are more resilient.

Which Apps Will Survive

Despite the challenges, cashback isn't disappearing entirely. Some apps have the structure and strategy to keep operating profitably.

Bank and Credit Card Programs

Cashback built into bank apps and credit cards (like Chase, Capital One, or digital banks) will survive because they're part of a larger business. The bank makes money from interchange fees, account fees, and lending. Cashback is a customer acquisition and retention tool, not the whole business model. These programs may reduce rates, but they won't disappear.

Large Established Platforms

Apps like Ibotta and Rakuten have the scale and retailer relationships to negotiate sustainable deals. They've diversified into browser extensions, card-linked offers, and direct brand partnerships. They may pay less than they used to, but they have multiple revenue streams and enough users to remain attractive to retailers. Check our Fetch vs Ibotta comparison to see how the major players stack up.

Apps With Unique Value

Some apps survive by offering something cashback-only apps can't match. Price comparison, deal finding, loyalty program integration, or exclusive discounts give users reasons to stay even if the pure cashback drops. The apps that become shopping utilities rather than just rebate machines have staying power.

Attention-Based Alternatives

The biggest shift is toward models that don't depend on retailer commissions at all. Apps that pay for attention, surveys, content engagement, or ad viewing have different economics. They get paid by advertisers who want eyeballs, not retailers who want sales attribution. This model is growing while traditional cashback shrinks.

The Future Is Attention

Cashback depends on spending money. VISU rewards your attention regardless of purchases. Different model, more sustainable.

Quick video. Earn your first reward.

Where Smart Earners Are Moving

People who take earning apps seriously are diversifying away from pure cashback dependency. Here's where the smart money is going.

Stacking Multiple Methods

Instead of relying on one cashback app for maximum rewards, experienced earners stack multiple smaller rewards. Credit card cashback plus receipt app plus browser extension plus loyalty program. Each individual reward is smaller than the old days, but the stack adds up. The best cashback apps still have a place in this stack, just not as the only component.

Attention Economy Apps

Apps that pay for watching content, viewing ads, or engaging with brands are growing. The economics are different: advertisers pay for attention regardless of whether you buy anything. This means rewards don't depend on retail margins or your spending habits. Learn how VISU rewards work to understand this model.

Survey and Opinion Platforms

Market research companies pay for consumer opinions. These platforms have existed for years but are getting better interfaces and faster payouts. The hourly rate isn't amazing, but it's not tied to shopping at all.

Creator and Referral Programs

Some earners are shifting from passive receipt scanning to active referral programs. Recommending products and services you actually use can pay more than any cashback rate, though it requires more effort and an audience.

Selective High-Value Cashback

Rather than scanning every receipt for pennies, smart earners focus on high-value opportunities. Big purchases through portals with elevated rates, stacking credit card bonuses with app cashback, or timing purchases around promotional periods. Quality over quantity.

What You Should Do Now

The cashback landscape is changing, but that doesn't mean you should stop earning. Here's how to adapt.

Audit Your Current Apps

Look at which apps you're actually using and how much you've earned in the past 6 months. If an app is paying you less than $5/month for real effort, it might not be worth the phone space. Keep the ones that deliver, cut the ones that don't.

Consolidate to Fewer, Better Apps

Having 10 cashback apps means 10 balances slowly accumulating toward 10 different minimums. Consolidate to 2-3 apps that cover your main shopping categories and actually reach payout regularly. Less fragmentation, faster access to your money. Focus on apps that pay real money reliably.

Add Non-Purchase Earning Methods

Don't put all your eggs in the cashback basket. Add at least one earning method that doesn't depend on spending money. Attention-based apps, surveys, or other reward programs give you income streams that aren't tied to retail economics.

Lower Your Expectations, Keep Your Habits

Cashback won't make you rich, and the rates are going down. But a 1-2% return on money you were going to spend anyway is still free money. Keep the habit of checking for cashback on big purchases, but don't stress about capturing every penny on small ones.

Watch for Shutdowns

If an app starts missing payments, dramatically cutting rates, or reducing customer service, cash out immediately. Don't let a balance sit in an app that might not be around next month. The best time to exit a declining app is before everyone else notices.

FAQ — Cashback Apps Dying

Are cashback apps actually dying?

Not dying, but definitely declining. Rates are lower, some apps have shut down, and the easy money era is over. The biggest apps will survive with reduced rewards, but many smaller ones won't make it.

Why are cashback rates dropping?

Several factors: retail margins are tighter, investor subsidies have dried up, data privacy changes reduced advertising revenue, and market saturation drove down the commissions apps can negotiate with retailers.

Which cashback apps are safest to use?

Bank-integrated programs (Chase, Capital One) and large established apps (Ibotta, Rakuten, Fetch) are most likely to survive. They have diversified revenue and enough scale to negotiate sustainable deals. Avoid small apps with high minimums and unclear business models.

Should I stop using cashback apps?

No, but you should diversify. Keep using the best cashback apps for big purchases, but don't rely on them as your only earning method. Add attention-based apps or other reward programs that aren't tied to spending.

What's replacing traditional cashback?

Attention economy apps are growing fastest. Instead of paying you a cut of retail commissions, these apps pay for your attention to ads and content. The economics are different and don't depend on retail margins. Check how to get paid for your attention to learn more.

How do I know if an app is about to shut down?

Warning signs include: dramatically reduced rates, slower customer service responses, delayed payouts, reduced app updates, and silence on social media. If you notice these, cash out your balance immediately.

Is my money safe in cashback apps?

Your earned balance is only as safe as the company behind it. These aren't bank accounts with FDIC protection. Keep balances low by cashing out regularly, and don't let large amounts accumulate in any single app. Check how to verify if an app is legit before trusting it with your time.

Will cashback ever go back to high rates?

Unlikely for the industry as a whole. Individual apps might offer promotional rates temporarily, but the structural factors pushing rates down (thin retail margins, mature market, less VC subsidy) aren't going away. The high rates of 2018-2021 were an anomaly, not the norm.

Future-Proof Your Earning

Cashback rates are falling. Attention rewards are rising. Get ahead of the shift and start earning with VISU today.

Quick video. Earn your first reward.