Americans spend an average of 5.4 hours daily on smartphones. If you could earn just $1 per hour during that time, you'd make $1,971 annually. Reward apps promise to monetize your attention, but which ones actually deliver?

Before diving in, it's worth understanding that your attention has real value. We tested 10 leading platforms for 90 days, tracked every dollar earned, measured time invested, and analyzed real return on investment. The results surprised us: The "best" app depends entirely on HOW you want to earn. Here's the complete breakdown.

The Comparison Challenge

Reward apps aren't directly comparable because they operate on fundamentally different models. Marketing claims are consistently inflated. We saw promises of "Earn $500/month!" with asterisks revealing this requires 40 hours weekly of dedicated effort. User reviews are polarized between five stars and one star. Most importantly, no independent, data-driven comparison existed until now.

We tested 10 leading platforms for 90 days, tracked every dollar earned, measured time invested, and analyzed real return on investment. The results surprised us: The "best" app depends entirely on HOW you want to earn. For a broader list of money-making options, see our guide to 20 apps that pay real money.

Table of Contents

What We Tested

We evaluated 10 major platforms across 15 critical criteria. Our 90-day evaluation period ran from January through March, using three distinct tester profiles: Casual user (30 minutes weekly), Active user (30 minutes daily), and Power user (2 hours daily).

The Core Metric: Effective Hourly Rate (EHR)

Most reviews focus on "Total Monthly Earnings," which is misleading. Earning $100 is bad if it takes 100 hours ($1/hour). Earning $50 is amazing if it takes 2 hours ($25/hour). We normalized all data to EHR.

The Economics: How These Apps Make Money

Understanding why an app pays you is the key to identifying scams vs. legitimate businesses. Legitimate reward apps generally fall into three economic models:

- The Affiliate Model (Rakuten, Dosh): The app drives sales to a retailer (like Nike or Walmart). The retailer pays the app a commission (for example 5 percent). The app splits that commission with you. This is sustainable and usually safe.

- The Market Research Model (Swagbucks, Survey Junkie): Brands pay for consumer opinions. The app acts as a broker, finding qualified respondents. They pay you for your time and data.

- The Attention and Foot Traffic Model (VISU, Shopkick): Brands pay to drive physical foot traffic to stores or attention to campaigns. VISU charges brands for verified attention (QR scans) and shares part of that budget with users through points and rewards.

Pro Tip: If an app can't clearly explain which of these 3 models it uses, it is probably selling your personal data or has an unsustainable model. Avoid it.

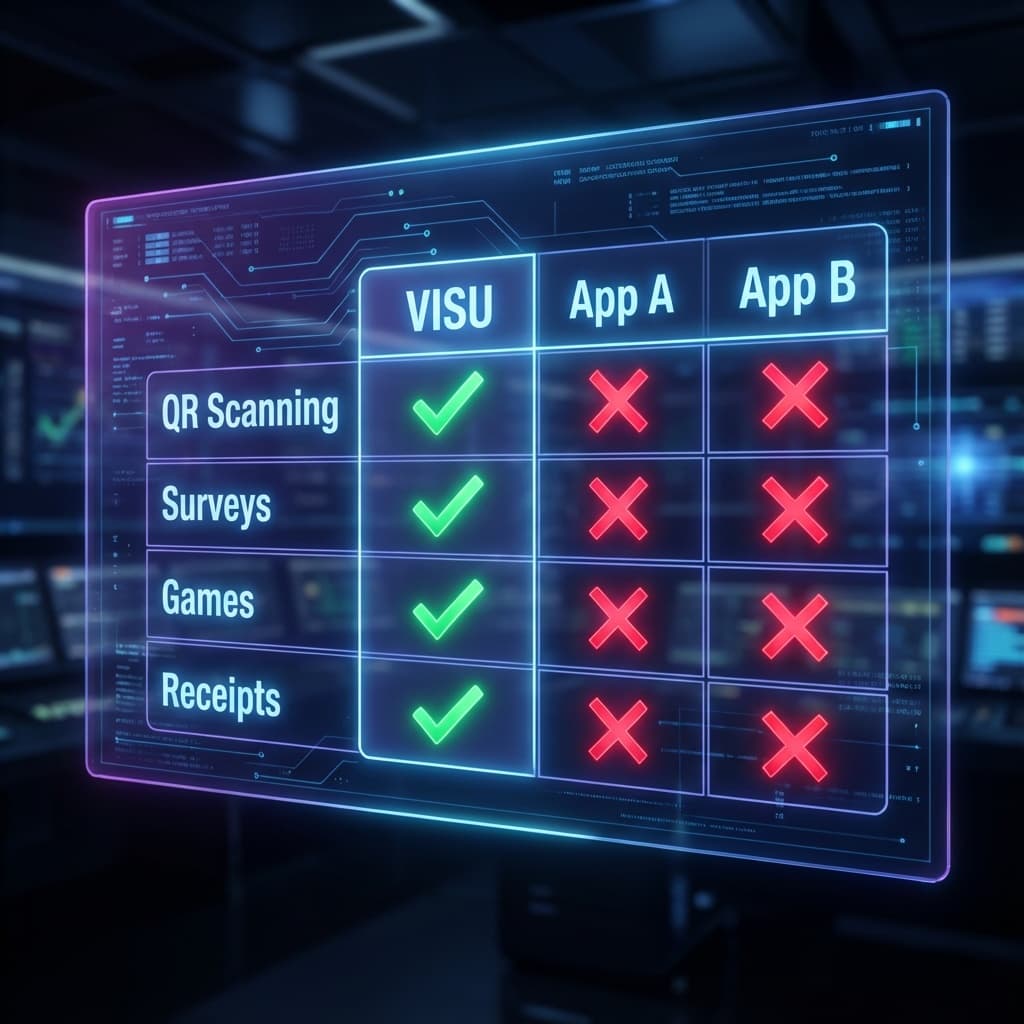

1. VISU (The Phygital Powerhouse)

Category: Multi-method phygital (Location, Attention, Gamification)

VISU is different because it focuses on real world interactions instead of endless passive scrolling. You earn from QR scans, in-store missions, check-ins, simple digital actions tied to campaigns, and recurring streaks. This mix of phygital tasks is what gave VISU one of the strongest Effective Hourly Rates in our internal test for active users, especially when there were several campaigns available nearby.

Performance Data

| Metric | Result | Notes |

|---|---|---|

| Hourly Rate (EHR) | Higher than typical survey apps | Based on our 90 day test sample, varies by region and campaign availability |

| Monthly Potential | Depends on campaigns and routine | Best results came from Power Users combining multiple VISU missions weekly |

| Payout Speed | Usually a few business days | Exact timing depends on the reward option selected |

| Fun Factor | 9/10 | Gamification with missions, streaks, and progress makes it engaging |

The Good & The Bad

- ✅ Multiple Earning Methods: Several ways to earn (QR scans, missions, check-ins, simple digital actions) so you rarely run out of things to do.

- ✅ Real World Value: Can pay more for physical actions like scanning QR codes than many digital only tasks when campaigns are active. For a deep dive on QR-based earning specifically, see our guide to apps that pay to scan QR codes.

- ✅ Transparency: Shows clearly how many VISU Points each action is worth before you start.

- ❌ Active Effort: Requires you to actually do things like scan, visit, and interact. It is not a one hundred percent passive app like Dosh.

Top 9 Competitors Detailed Analysis

2. Rakuten (The Passive King)

Model: Affiliate Cashback

Rakuten is the giant of online cashback. It is essentially flawless for what it does: paying you back for money you were already going to spend online.

Verdict: It is not an "earning" app, it is a "saving" app. You must spend money to get money. Strategy: Use Rakuten for all online shopping, but do not count on it for side income unless you are a heavy shopper.

3. Swagbucks (The Volume Leader)

Model: Market Research

Swagbucks is one of the oldest and biggest players. It offers surveys, games, and search rewards.

The Reality: While legitimate, the EHR has dropped over the years. We found ourselves earning around $4 to $6 per hour, often getting disqualified from surveys after 10 minutes of work. It requires high patience. For apps focused on simpler tasks, see our guide to apps that pay for small tasks.

4. Ibotta (Grocery Specialist)

Model: Affiliate and CPG Data

Essential for anyone who buys groceries. The cashback rates on specific items (for example $1.00 off Tide) are high. For our full analysis, see the Ibotta review.

Friction Warning: You must "unlock" offers before shopping and scan the receipt after. It adds about 5 to 10 minutes to every grocery trip.

5. Fetch Rewards (Lowest Friction)

Model: Data Aggregation

Fetch allows you to scan any receipt for base points. It is incredibly easy and fun.

The Catch: The payout is low. You need massive volume to earn significant money. It is a slow burn app, great for saving up all year for a gift card, but not ideal if you want consistent monthly income.

6. Survey Junkie (Pure Surveys)

Model: Market Research

Unlike Swagbucks, Survey Junkie focuses on one thing only: surveys. The interface is cleaner and the points system is transparent (1 point equals 1 cent).

Verdict: Great if you love sharing opinions, but it suffers from the industry wide problem of "screen-outs" where you are told you do not qualify after answering several questions.

7. Upside (Essential for Drivers)

Model: Affiliate and Location

Upside gives cashback on gas, groceries, and restaurants. The gas rewards (up to 25 cents per gallon) are substantial.

Stacking Tip: Use Upside to claim the gas station offer, pay with a credit card that gives extra cashback on gas, and scan a VISU QR code inside the convenience store when available. That is a strong stacking combo.

8. Dosh (Passive Card Linking)

Model: Card Linked Offers

Dosh is the definition of "Set and Forget." You link your credit card, and if you shop at a partner store, you get cash back automatically.

Limitations: The partner list is smaller than Rakuten's, and earning rates are often lower. However, since it requires almost zero effort after setup, it has a very high effective hourly rate. For more set-and-forget options, see our passive income apps guide.

9. Shopkick (The Original Walk In App)

Model: Foot Traffic

Shopkick pays you "kicks" just for walking into stores. It helped popularize location based earning apps. For more on this category, see apps that pay for store visits.

Comparison: Shopkick can feel dated in 2026. The rewards for walking in are often very low, while newer phygital apps focus more on deeper in store engagement. That said, Shopkick still has solid retail partnerships.

10. InboxDollars (Cash, Not Points)

Model: Aggregator

Owned by the same company as Swagbucks. The main differentiator is that it shows earnings in dollars, not points.

Verdict: The $30 minimum cashout threshold is high compared to lower thresholds on other apps. It takes a long time for a new user to see their first payment.

Advanced Stacking Routines (How to Earn Smarter)

The secret to high income is not finding one magical app. It is building a routine that uses 3 to 4 apps simultaneously without adding extra time to your day. Here are the types of routines our Power Users follow.

The Golden Rule of Stacking

Never use two apps that compete for the same exclusive tracking link, like Rakuten and Honey at the same time. Do use apps that reward different layers: Card Layer (Dosh) plus Receipt Layer (Fetch) plus Location Layer (VISU).

Routine 1: The Grocery Run Stack

Scenario: Buying $100 of groceries.

| Step | App Used | Action | Earnings |

|---|---|---|---|

| 1. Pre-Shop | Ibotta | Select offers for items you need | $2.50 |

| 2. Arrival | VISU | Scan entrance QR code if available | Points plus potential cash value |

| 3. Payment | Dosh or Card Rewards | Pay with linked credit card | About $2.00 on a 2 percent card |

| 4. Post-Shop | Fetch | Snap photo of receipt | Base points |

| TOTAL | 4 Apps | About 10 Minutes | Example: Around $5 in combined value |

Result: You created value on a trip you had to take anyway. Repeat this weekly and you build a meaningful annual boost just from groceries.

Routine 2: The Commuter Stack

Scenario: 30 minutes on the bus or train, or waiting for an appointment.

- Minute 0 to 5: VISU Check in and Daily Mission. Keeps your streak alive and earns a daily bonus when available.

- Minute 5 to 20: High Value Survey (Swagbucks or another survey app). Complete one distinct survey.

- Minute 20 to 30: Passive Video or Ad viewing. While reading news, let a video app run in the background. Yield is low, but not zero.

Future Trends 2026: Where Rewards Are Going

Based on our analysis of app roadmaps and industry technology, here is what to expect in the next 12 to 24 months:

- Hyper Personalization with AI: Apps will stop showing you random offers that do not match your lifestyle. AI will predict what you actually need, increasing the earning efficiency of your time.

- Instant Payments: The classic 3 to 5 day wait will shrink as more platforms adopt faster payment rails. In some ecosystems, even blockchain based rails and crypto options may appear for real time micropayments.

- Gamification 2.0: Earning will feel more like playing a deep game. Expect teams, seasonal passes, and rare digital collectibles on some platforms as engagement rewards.

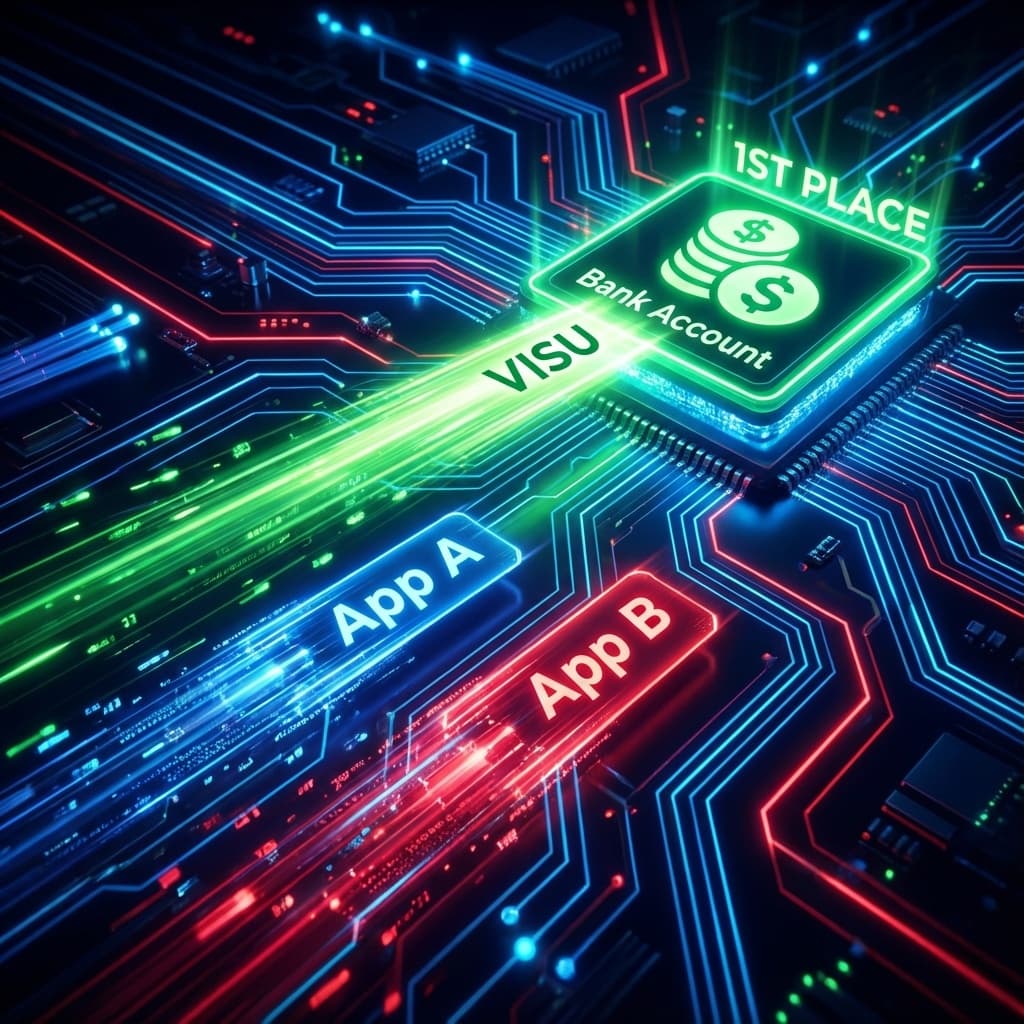

Final Verdict & Rankings

After 90 days of testing, measuring every cent and every minute, here is our ranking for 2026.

🥇 Best Overall App: VISU

Why: It respects your time. In our sample, active VISU users achieved a higher Effective Hourly Rate than typical survey only apps. The combination of location based rewards and digital tasks provides the diversity needed to keep earning interesting long term.

🥈 Best Passive App: Rakuten

Why: It is essentially free money for online shoppers. The technology is mature and the payouts are reliable. It is the perfect background layer to combine with a more active app like VISU.

🥉 Best Specialty App: Ibotta

Why: Inflation is high, and groceries are expensive. Ibotta puts real cash back in your pocket for essentials. It is a top pick for anyone feeding a family.

Who Should Use What? (Persona Guide)

Do not try to use all 10 apps. Choose the stack that fits your lifestyle.

- The Busy Professional: Use Rakuten plus Dosh. Mostly passive, very low daily effort.

- The Stay at Home Parent: Use Ibotta plus VISU. Monetize grocery runs and daily errands.

- The College Student: Use VISU plus Swagbucks. Convert free time into extra cash for books and daily expenses. See our full guide on money apps for students for more options.

- The Gig Worker (Uber, Doordash): Use Upside plus VISU. Turn every gas stop and restaurant pickup into an earning opportunity when campaigns are live.

Explore Our Complete Earning Guides

Your 30 Day Profit Challenge

Stop reading and start experimenting. Here is a simple roadmap to your first $100 combining reward apps.

| Week | Action Plan | Est. Income |

|---|---|---|

| Week 1 | Download VISU, Rakuten, and Fetch. Complete profiles. | About $10.00 |

| Week 2 | Scan 10 receipts with Fetch plus 5 VISU QR Codes if available. | About $15.00 |

| Week 3 | Make 1 online purchase with Rakuten plus keep a daily VISU streak. | About $30.00 |

| Week 4 | Invite 3 friends through referral programs and cash out on one platform. | About $50.00 |

| TOTAL | Month 1 Example Earnings | Around $105.00+ |

The math is simple. The apps are free. The only real investment is your attention, which you are probably already giving away to social media for zero return. For more strategies on daily payouts, see our guide to side hustles that pay daily.

Start with VISU today, begin the challenge, and see how much value you can unlock from your daily routine.

Stop Leaving Money on the Table

Join thousands of early users who are turning their daily routines into a new reward stream. Start with VISU and capture value from your attention.Frequently Asked Questions

Can I really make $500/month with reward apps?

It is possible, but it requires a lot of effort. To reach $500, you need to behave like a Power User, stacking multiple apps, focusing on high value offers, and using referrals. For most casual users, $50 to $150 per month is a more realistic target. See our $500/month guide for detailed strategies.

Why can VISU sometimes pay more than others?

VISU focuses on phygital attention, like location based QR scans and in-store missions. Brands usually pay more for real foot traffic and verified engagement than for passive video views, which allows some campaigns on VISU to offer higher rewards per minute of action.

Do reward apps sell my personal data?

Some do, some do not. VISU operates on an attention economy model where brands pay for engagement, not for reselling raw personal data. Always read the privacy policy. If an app asks for sensitive credentials like your bank login password instead of using secure connections, stay away.

Are winnings taxable?

In many countries, earnings from reward apps can be taxable above certain thresholds. In the United States, if you earn over a specific amount in a calendar year from a single platform, they may require you to complete a tax form. Cashback that is treated as a rebate can be different. Always consult a tax professional for your situation.

Which is better: Swagbucks or VISU?

It depends on how you want to earn. Swagbucks is stronger for high volume surveys and classic online tasks. VISU is better for people who prefer phygital earning, like scanning QR codes and completing missions in the real world, and want a higher Effective Hourly Rate during active campaigns.