When Netflix CEO Reed Hastings said "We compete with sleep", he was not joking. He was describing the real financial mechanics of the modern economy. Every brand, platform, publisher, and creator is competing inside the same market. The traded asset is not oil or gold. It is human focus.

In this environment, attention behaves like a currency. It is scarce, it can be priced, it flows between actors, and it can be converted into revenue. The platforms that dominate the twenty first century are not the ones that own factories or real estate. They are the entities that have built the most efficient systems for capturing, packaging, and selling attention.

This 2026 report explains how that market actually works. We will look at how different industries value attention, how platform business models convert focus into cash, how "exchange rates" for attention change by context, and why new models that pay users for their attention are emerging as a rational response to an unfair system.

The Global Attention Market

The scale of the global attention market is difficult to grasp until you convert it into numbers. There are roughly 8 billion people on the planet. If each person is awake for 16 hours a day, that is 960 minutes of potential attention per person. In aggregate, this equals approximately 7.68 trillion attention minutes per day.

Of course, not all of these minutes are "tradable". People sleep, commute, talk, cook, and live offline. But a growing portion of those minutes passes through digital environments where attention can be observed, measured, and monetized. This attention fuels an advertising industry that now exceeds 700 billion dollars in annual spend, plus trillions more in commerce that is guided by digital touchpoints even when the final purchase happens offline. For a deeper dive into the mechanics, see our attention economy guide for marketers.

In practical terms, this means every minute your customer spends on a screen is part of an auction you cannot see. Algorithms are constantly deciding which messages get shown, which brands get exposure, and how much that exposure is worth. If your brand is not actively managing attention as a financial asset, you are effectively sitting out of the most important market of the decade.

Table of Contents

Thinking of attention only as “reach” or “impressions” dramatically underestimates its economic weight. A brand that understands the true unit economics of attention can reallocate spend, improve margins, and outbid competitors in the places that matter. The rest of this report is designed to give you a practical toolkit for doing exactly that.

Valuing Attention: The Methodologies

Unlike fiat currencies that have central banks and official exchange rates, attention has no single price. Its value is determined by context. One minute of distracted scrolling while watching TV is not worth the same as one minute of focused attention during a product demo. For executives, the key question is simple: “What is one minute of my customer's focused attention worth to my business?”

To answer that question rigorously, we can apply three complementary valuation methods. Each one looks at attention from a different angle: time, outcomes, and portfolio impact. Used together, they create a robust framework for treating attention as a measurable asset.

Method 1: Time-Based Valuation

The first method treats attention as an opportunity cost of time. If a customer spends 60 seconds with your message, they are giving up the chance to do something else with that time: work, relax, or pay attention to another brand. A simple way to approximate this is to anchor attention to average hourly earnings.

Attention Value = (Time Spent) × (Average Hourly Wage)

Using average United States wages at roughly 28.50 dollars per hour, each minute of attention is theoretically worth around 0.47 dollars. A 30 second ad therefore “costs” a user approximately 0.24 dollars in time. At global scale, if one million people give you 30 seconds of genuine focus, the aggregate economic value of that time is roughly 240 thousand dollars.

Of course, customers are not sending you invoices for those micro commitments. But this framing is useful, because it reminds marketers that attention is not free. If your creative is irrelevant or annoying, you are effectively asking people to donate micro slices of their time and getting nothing in return. That is not sustainable in a world where consumers are increasingly aware of the value they generate.

Method 2: Conversion-Based Valuation

The second method ties attention directly to financial outcomes. Instead of asking what a minute of attention is worth in abstract terms, you ask what a minute of attention is worth inside a specific revenue journey, based on conversion performance.

Attention Value = (Gross Profit from Conversions) / (Total Attention Time Invested)

Consider these simplified benchmarks across industries, expressed as an estimated value per minute of focused attention:

| Industry | Context | Value Per Minute |

|---|---|---|

| E-commerce | Product Page or Offer Detail | $0.50 - $1.50 |

| Financial Services | Credit, Insurance or Investment Research | $50.00 - $200.00 |

| B2B SaaS | Sales Meeting or Demo | $100.00 - $500.00 |

| Social Media Platforms | Passive Feed Scrolling | $0.01 - $0.05 |

These numbers are not theoretical. They come from simple math. If a B2B SaaS company hosts a 30 minute demo that closes 1 in 5 prospects and each new contract generates 50,000 dollars of gross profit over its lifetime, then those 30 minutes of attention from five decision makers are extraordinarily valuable.

By contrast, one minute of casual attention in a social feed may be almost worthless in direct revenue terms, even if it is cheap to purchase. This is where many brands fall into a trap. They chase low cost impressions instead of high value attention, because they are looking at CPM instead of looking at revenue per minute of real focus.

Method 3: Portfolio-Based Valuation

A third layer looks at attention as part of an asset portfolio. Owned attention assets such as email lists, app installs, loyalty program members, or VISU users represent future earning power. Each attention asset can be modeled with projected engagement, retention, and revenue over time.

In this model, you are not just valuing the minute of attention you buy today. You are valuing the stream of future attention you can access without paying a third party again. This is where products like VISU become strategically important, because they give brands a channel for direct, permission based, reward driven contact with users that is not fully controlled by social algorithms.

Platform Monetization Models: The Revenue Machines

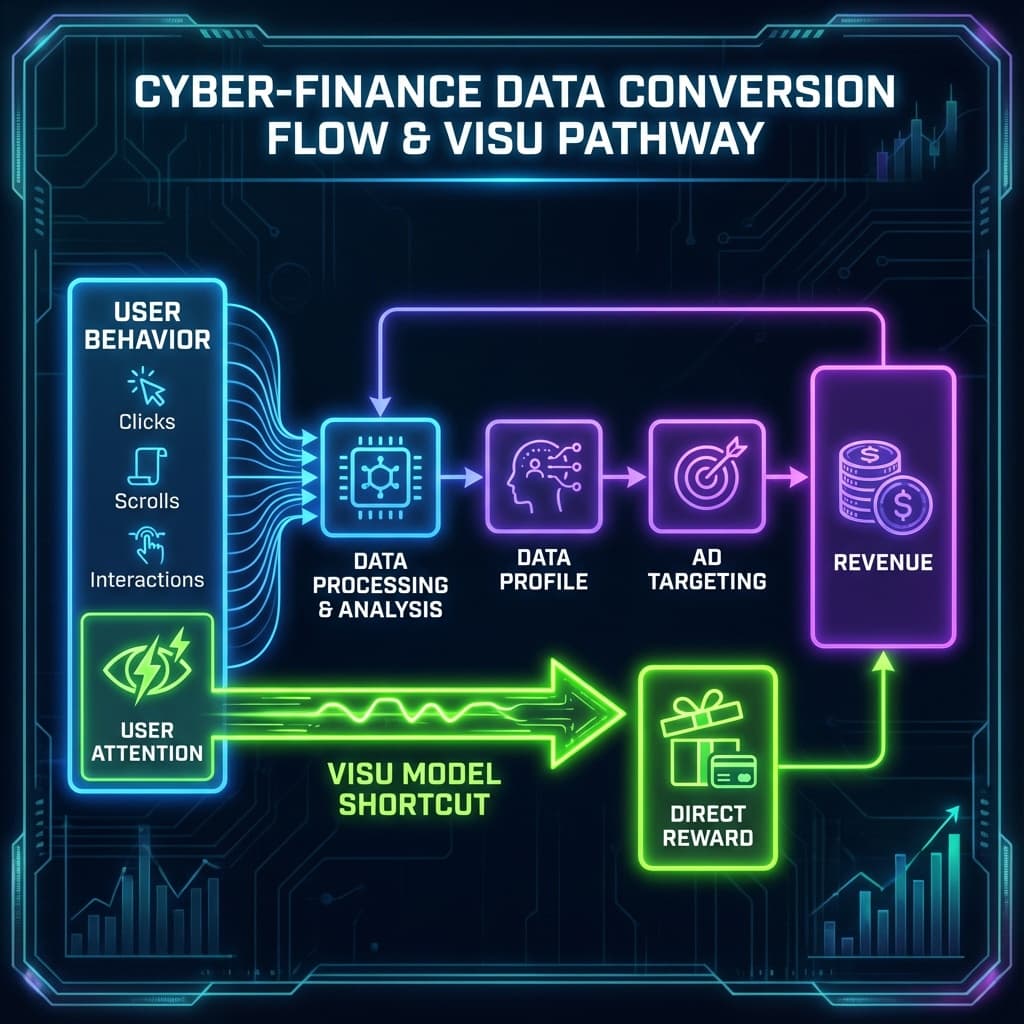

Attention on its own does not generate revenue. It has to be attached to a monetization mechanism. The companies that dominate digital markets are the ones that have built extremely efficient machines for taking raw attention and turning it into predictable cash flows.

At a high level, there are three dominant platform models. Most consumer facing experiences you see on your phone today are powered by some combination of these.

1. Advertising-Supported Model (Meta, Google, TikTok)

In the classic ad supported model, the platform’s primary product is not the app itself. The true product is the user’s attention. The platform attracts users with free services such as social feeds, videos, maps, email, or search. It then aggregates the resulting attention and sells access to that attention to advertisers.

Revenue is driven by auctions. Buyers bid for impressions, clicks, video views, and conversions. The platform captures the full margin between what brands are willing to pay and the infrastructure cost to deliver those impressions. In mature ad platforms, this margin can reach 80 to 85 percent. Users, who are the ones generating the underlying value, receive zero direct compensation.

This model has been incredibly profitable, but it has two structural weaknesses. First, it relies on ever increasing ad load to hit growth targets, which drives user fatigue and ad blindness. Second, it is increasingly out of sync with consumer expectations about fair value exchange. People understand that their data and time are being monetized, and they are starting to ask what they get in return.

2. Subscription and Paywall Model (Netflix, Spotify, News Sites)

The second model monetizes attention indirectly through recurring payments instead of selling ad slots. A subscription brand charges users for ongoing access to content or functionality. In this case, attention is still the core asset, but the revenue mechanism is different: the more consistently a user gives attention, the less likely they are to churn, and the higher their lifetime value.

Here, the financial challenge is retention. If attention drops, cancellations rise. These businesses are effectively in a constant race to produce enough value to justify the monthly debit. In practice, many brands combine subscription and advertising models, which again raises questions about how fairly user attention is being treated.

3. Attention Rewards Model (VISU)

The third model is newer and more aligned with the idea of attention as a tradable currency. Instead of selling access to user attention and keeping almost all of the proceeds, attention rewards platforms pay users for opting in and engaging with branded experiences.

In VISU's case, brands pay to run campaigns that drive in store visits, QR scans, or verified engagement with specific actions. Users participate voluntarily and receive a share of the campaign budget in the form of rewards, points, or cash equivalents. Creators and partners can also receive a share when they help bring users into the ecosystem.

- Brands Pay: for guaranteed, verified engagement instead of vague impressions.

- VISU Distributes: a significant portion of that budget, typically 60 to 70 percent, directly to users and creator partners.

- The Platform Keeps: the remaining share, often 20 to 30 percent, to fund infrastructure, operations, and product development.

Economic Shift: Traditional platforms capture more than 90 percent of the value created by user attention. Attention rewards models like VISU deliberately redistribute a majority share back to users and the ecosystem, which leads to higher quality attention because participation is voluntary and incentivized.

From an economic perspective, this is similar to moving from a tax system where one actor keeps almost everything to a revenue share system where value flows back to contributors. For brands, the key benefit is not only ethical alignment. It is also performance. When users know they are being rewarded, they are more likely to pay attention, complete steps, and share accurate data.

Exchange Rate Dynamics: Why Attention Value Varies

Not every unit of attention trades at the same price. Just as a dollar does not always equal a euro in foreign exchange markets, one minute of attention in one context can be worth 100 or even 1,000 times more than a minute in another context. Understanding these “exchange rates” is the foundation of attention arbitrage.

Three main factors drive these variations: intent, audience profile, and engagement depth. When you combine these correctly, you can move budget out of low value attention pools and into high value environments without necessarily increasing total spend.

1. Intent: The Primary Driver of Value

Intent is the single strongest predictor of conversion and therefore the biggest driver of attention pricing. Low intent attention is cheap and usually comes in large volumes. High intent attention is scarce and therefore expensive, but it also produces outsized returns.

- Low Intent: Passive social scrolling, random video watching, or generic display impressions. Monetary value often sits at or below $0.001 per minute with conversion probabilities near zero.

- Mid Intent: Category research, reading reviews, or watching product comparisons. Value per minute rises sharply as users move closer to making a decision.

- High Intent: Branded search, cart activity, in store product interaction, or scanning a campaign QR code at the point of decision. Value can easily reach $5.00 to $50.00 per focused minute because the probability of conversion is 20 to 50 percent or higher.

Many marketing budgets are still over weighted toward low intent environments simply because they offer cheap CPMs and impressive impression counts. In an attention as currency view, this is like buying a huge amount of low quality currency that cannot be exchanged for anything significant.

2. Demographics: The Value Multiplier

Not all attention comes from the same type of customer. A minute of attention from a teenager with limited spending power is not worth the same as a minute from a C level executive who controls a large budget. Demographic and firmographic factors act as multipliers on base attention value.

As a rough rule of thumb, attention from high income or high decision power audiences can be worth 5 to 10 times more than attention from low income audiences in the same context. This is why niche B2B platforms can charge extremely high rates for small volumes of highly qualified attention while mass social networks operate at massive scale with much lower unit value.

3. Quality: Engagement Depth and Verification

Active attention includes clicks, answered questions, completed surveys, QR scans, store visits, and mission completions where the user has clearly understood and responded to a prompt. This kind of attention often carries "verified intent" and can be worth $0.50 to $2.00 or more per interaction for brands in consumer categories, and far more in B2B or financial contexts.

Passive attention includes things like viewable impressions, auto playing videos, or quick scroll by exposures. In many cases, this attention is worth cents or fractions of a cent per minute.

Active attention includes clicks, answered questions, completed surveys, QR scans, store visits, and mission completions where the user has clearly understood and responded to a prompt. This kind of attention often carries “verified intent” and can be worth $0.50 to $2.00 or more per interaction for brands in consumer categories, and far more in B2B or financial contexts.

Strategic Insight: Arbitrage

Smart brands look for pools of attention where the market price is lower than the true business value. VISU represents this kind of quality arbitrage. A brand might pay a small reward to a user to scan a QR code and complete a short interaction, but the resulting data and conversion probability can be worth many times more than the cost of that reward.

Brand Strategies for Monetizing Captured Attention

Capturing attention is only half the equation. The real performance gap between winning and losing brands emerges in how efficiently that attention is converted into revenue, data, or long term retention. Once a brand has earned a moment of focus, it must decide which economic pathway to activate. Each pathway carries different operational requirements and different ROI profiles.

Broadly, there are three strategic conversion routes: immediate revenue, data asset building, and attention resale. Most modern brands blend all three, but each one plays a distinct role in the larger economic model of attention.

Strategy A: Direct Revenue Conversion

This is the most intuitive pathway. A user gives attention, the brand presents an offer, and the user makes a purchase. This pathway is the backbone of ecommerce and the dominant model behind fast moving consumer brands.

Path: Attention → Product Offer → Purchase → Revenue

Direct conversion strategies thrive when the user is already in a high intent state. For example, when a customer scans a VISU QR code in a store aisle, their intent is significantly higher than when they see a generic display ad. Reducing friction in this moment is critical. One click checkout, dynamic offers, tailored bundles, and localized pricing can dramatically lift the revenue per minute of attention.

Brands that excel at direct conversion design their attention flows like optimized supply chains. They track each step, eliminate unnecessary clicks, and measure drop off rates with surgical precision. The most advanced teams use real time offer personalization to match the exact reason a user engaged with the content in the first place.

Strategy B: Data Asset Building

Not all attention needs to convert immediately. Sometimes the optimal strategy is to transform attention into zero party data that increases the value of future interactions. Traditional data collection methods are losing effectiveness due to privacy regulation and platform policies. Zero party data solves that problem by collecting information the user willingly provides.

Path: Attention → Voluntary Data Sharing → Enhanced Targeting → Higher LTV

Platforms like VISU excel in this model because they reward users directly for completing short preference surveys, voting, answering questions, or providing information about their interests. Participation rates often exceed 80 percent, far higher than conventional email surveys that struggle to reach 5 percent.

Over time, each piece of collected data improves segmentation, recommendation accuracy, and personalization engines. When a brand owns this data, it effectively owns a renewable stream of future attention that does not require ongoing ad spend.

Strategy C: Attention Resale (Creator & Partner Model)

Creators who use VISU referral tools add a new income layer. When they bring users into the VISU ecosystem, they earn a percentage of that user's earnings over time. This transforms creators from ad dependent publishers into participants in the attention economy infrastructure itself.

Creators who use VISU referral tools add a new income layer. When they bring users into the VISU ecosystem, they earn a percentage of that user’s earnings over time. This transforms creators from ad dependent publishers into participants in the attention economy infrastructure itself.

In practical terms, creators are no longer just selling temporary exposure. They are acquiring shareholding rights in the future earnings of the attention they aggregate. For creators with high trust and strong communities, this model compounds value over years instead of minutes.

Cost-Benefit Analysis: Calculating Attention ROI

Below is a comparative ROI model between traditional display advertising and attention reward platforms like VISU. The goal is not to show which is universally "better", but rather to highlight how different the cost structures are and why intentional reallocation can unlock massive efficiency gains.

Below is a comparative ROI model between traditional display advertising and attention reward platforms like VISU. The goal is not to show which is universally “better”, but rather to highlight how different the cost structures are and why intentional reallocation can unlock massive efficiency gains.

| Metric | Traditional Display Ads | VISU Attention Rewards |

|---|---|---|

| Cost Per Attention Minute | $23.20 | $0.45 |

| Attention Quality | Passive / Interruptive | Active / Voluntary |

| Conversion Rate | ~2% | ~15% |

| Data Collected | Minimal / Inferred | Rich / Consent Based |

| Relative Efficiency | 1x Baseline | 52x More Efficient |

The efficiency gap becomes obvious when you consider the mechanics behind each model. Traditional ads suffer from banner blindness and algorithmic decay. You pay for exposures that users might not even notice. With attention reward models, you pay only for verified interactions, which means the cost per effective minute collapses while the probability of a profitable conversion rises.

Emerging Attention Marketplaces & Future Predictions (2025–2030)

The attention economy is entering a structural transition. For the last twenty years, attention was primarily traded through large intermediaries: ad networks, social platforms, and data brokers. The next five years will see the rise of decentralized attention markets where value flows more directly between brands and individuals.

Three major developments will define the next phase: tokenized attention assets, AI driven dynamic pricing, and a societal shift toward what economists are calling “attention rights”.

1. Attention Tokens & Blockchain Models

Brave Browser pioneered this idea with the BAT token. VISU is extending the concept to real world interactions by enabling users to earn rewards for verified store visits, scans, and missions. Over time, users may accumulate "attention tokens" that represent the economic value of their participation across multiple campaigns.

Brave Browser pioneered this idea with the BAT token. VISU is extending the concept to real world interactions by enabling users to earn rewards for verified store visits, scans, and missions. Over time, users may accumulate “attention tokens” that represent the economic value of their participation across multiple campaigns.

2. AI Hyper Personalization

By 2027, most attention markets will run on dynamic pricing. AI systems will assess the user’s context, intent, historical behavior, and responsiveness to determine the real time price of a minute of their attention. When a user is in a buying mood, the price rises. When they are distracted, the price falls.

This creates more efficient markets. Instead of paying the same flat rate for all impressions, brands will be able to allocate budget precisely where attention is most convertible.

3. From "Data Privacy" to "Attention Privacy"

As consumers become more aware of how their attention is monetized, public pressure will shift the policy conversation. People will demand visibility into how their time is priced, who profits from it, and what they get in return. New rights—such as the right to ignore or the right to fair value exchange—will become mainstream talking points.

In practical terms, brands that adopt transparent, reward driven attention models early will enjoy a reputational advantage. They will not have to rebuild user trust after regulations force the change.

Strategic Recommendations for Business Leaders

Understanding the mechanics of attention is no longer optional for leadership teams. As budgets shift, markets tighten, and user behavior becomes more selective, organizations that treat attention as a financial asset will outperform competitors on both efficiency and long term resilience. Below are tailored recommendations for C level decision makers across strategy, marketing, and finance.

For CEOs & Strategists

- Recognize Attention as an Asset Class: Start tracking owned attention pools (email lists, communities, app users) as intangible assets with measurable future value. Investors will begin treating attention as a leading indicator of revenue stability.

- Shift Allocation: Move from a 90/10 rented attention model (ads) to a healthier 60/40 split between owned and rented attention by 2027.

- Integrate Attention Markets Into Core Strategy: Treat attention flows like supply chains—optimized, predictable, and measurable.

For CMOs (Marketing)

- Kill Vanity Metrics: Impressions, reach, and CPM no longer reflect performance. Replace them with Cost per Attention Minute and Engagement Depth.

- Invest in High Intent Attention: Reward based models, in store scans, and contextual triggers outperform generic ads in both cost efficiency and conversion rate.

- Leverage Zero Party Data: Incentivize users ethically to share preferences, reducing dependency on external data providers.

For CFOs (Finance)

- Treat Attention Acquisition as CapEx When It Produces Owned Assets: When attention leads to opt ins or data that can be monetized over years, capitalize part of the spend.

- Identify Arbitrage Opportunities: Attention Rewards platforms represent underpriced, high quality attention. The market will correct—early adoption yields oversized returns.

- Model LTV Impact: Users who voluntarily engage produce higher retention and higher repeat conversion rates. Incorporate this into revenue projections.

Conclusion: The Currency Revolution

Attention is no longer a metaphorical currency—it is becoming a literal one. The infrastructure to measure, price, trade, and compensate attention is being built right now. The shift mirrors the early days of programmatic advertising, but with one critical difference: for the first time, the individual is becoming an active participant in the market instead of an exploited resource.

Traditional ad systems were built on extraction. Platforms captured value, users received none, and brands paid for inefficiency. The next wave prioritizes transparency, fairness, and measurable outcomes. Platforms like VISU are correcting the imbalance by compensating users directly, rewarding creators, and providing brands with guaranteed, high intent attention at a fraction of historical cost.

The companies that embrace “attention as currency” will build competitive moats across cost structure, data quality, user trust, and long term loyalty. Late adopters will face rising acquisition costs and diminishing returns.

The question is no longer whether attention has value. The question is: How will you spend it, acquire it, protect it, and profit from it?

Pilot the Attention Economy

Don't wait for regulation or market pressure to force your hand. Partner with VISU to build a transparent, ethical, high ROI attention strategy now.

Frequently Asked Questions

Is attention really a currency?

Yes. Attention is scarce, divisible, measurable, and traded at massive scale. It satisfies all economic criteria required to behave as a functional currency within digital ecosystems.

How do you calculate the value of one minute of attention?

The value depends on user intent and context. Passive scrolling may be worth pennies, while product research or high intent search behavior can be worth dollars per minute due to conversion probability.

What is Attention Arbitrage?

It is the practice of buying attention where it is inexpensive and converting it into high value outcomes, profiting from the spread. Attention Rewards platforms currently offer the best arbitrage opportunity in the market.

Why are brands shifting to Attention Rewards?

Because traditional ads are being ignored. Rewards guarantee voluntary engagement and deliver significantly higher attention quality at a much lower effective cost.